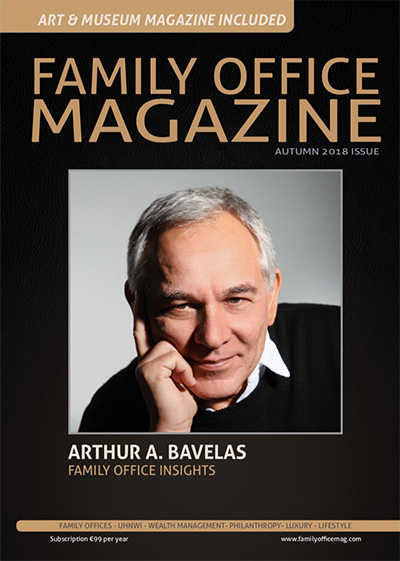

Q&A with Arthur Andrew Bavelas-This One Goes to Eleven-The Bavelas Index (TBI)™ Family Office Investor Sentiment Index™

Founder

Principal Series:

What are other family offices investing in?

AND

What do other family offices think about said asset class, trend, technology, political scenario, family governance issue, [topic of the minute]?

Super grateful to my Family Office Magazine friends for their kind recognition.

AA Bavelas 1 Article 12.2020 Family office Magazine article preview page 11

Scan or click

You can view the magazine on their website – www.familyofficemag.com

Family Office Magazine is the premier gateway to the Family Office and UHNWI International Community. The publication is the most prominent publication in this sector and is an authority on Family Office news and events. It has contributions and articles from some of the World’s most prominent Family Offices, Private Banks and Wealth Management Firms.

Free Access. Subscription is recommended.

JOIN US-WHY FAMILY OFFICE INSIGHTS?

RADICAL TRANSPARENCY

EVERYONE HAS AN AGENDA

Family office investors- free easy access link.

All others- free easy access link.

“Where one stands, often depends on where one sits”

Family Office Insights agenda: to grow a well curated like-minded investor community that seeks to help protect, expand, and nurture wealth for multiple generations.

A safe environment to explore opportunities

A safe place to meet other like-minded peers

No Community Fees

No Success Fees

No Pressure

As a Community Participant You Are Welcome to Enjoy:

Exclusive Community Opportunity Gathering Invitations

“Opt-In” Interest Profile

Peer-To-Peer Gatherings & Private Networking

Co-Investment Opportunities with Like-Minded Investors

Peer Insights Reports

Commune With Your Peers: A safe, private, curated environment where investors not only learn from experts, thought leaders and asset managers, but also from their peers. The private Family Office Insights investor community represents a wide spectrum of investment views and levels of investment knowledge. Family Office Insights community participants share a commitment to improving their understanding of the complexities of the financial landscape with their peers and seek to become more effective stewards of wealth.

Family Office Insights is a voluntary, “opt-in” collaborative peer-to-peer community of single family offices, qualified investors and institutional investors. Join the community here www.familyofficeinsights.com

Arthur Andrew Bavelas-This One Goes to Eleven-The Bavelas Index (TBI)™ Family Office Investor Sentiment Index™

Arthur Andrew Bavelas, Founder of BavelasGroup Family Office, Family Office Insights, Arthur’s Round Table Series, Family Office Funding Challenge , Global Business Network, The Family Office Impact Summit, Creator of The Bavelas Index (TBI)™ Family Office Investor Sentiment Index™

As a globally recognized entrepreneur, author, and family office investor. Arthur Bavelas is a pioneer in developing one of the first private opportunity review networks, Family Office Insights, for investors within the family office community.

Fostering a collaborative method of evaluation and delivering a more efficient potential investment pipeline, Family Office Insights initiates timely peer-to-peer review of limited access investment opportunities.

Driven by dissatisfaction at lack of choices for private capital allocation, he founded Family Office Insights in 1998 to provide meaningful access and engagement opportunities for active, socially conscious entrepreneurs and wealth managers.

Mr. Bavelas draws upon his own experience founding, building and exiting a successful technology startup to evaluate current opportunities that often feature innovative intellectual property, bridge customer/market access, or solve some of the world’s most daunting challenges.

As a founder of The Family Office Impact Summit and other impact efforts, Mr. Bavelas seeks to raise awareness and provide open access to technologies and innovation to effect societal and environmental change.

He frequently speaks about wealth preservation, the new economy, entrepreneurship and legacy investing. His has co-authored several books and has been published in The Wall Street Journal, Bloomberg, and many others.